Ally Bank SWIFT/BIC Code

The SWIFT-code for Ally Bank is ALLYUS33. The bank has 276 departments so make sure you use the right code. Read on to know more about what is a SWIFT code and how to use it for wire transfers.

The SWIFT code for Ally Bank

What is the SWIFT code for Ally Bank?

| SWIFT-Code Ally Bank: | ALLYUS33 |

| Ally Bank headquarters: | 200 West Civic Centre Drive Sandy, UT 84070 |

| Departments: | 1 departments across the United States |

| Country: | The United States |

You’ve probably heard of SWIFT code before but maybe aren’t quite sure of its meaning and use. A SWIFT code (or a SWIFT number) is used for the identification of banks and financial institutions globally when making international money transfers. This code will identify such information as the country, bank, and branch of the recipient’s account. The SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. Don’t be confused if you come across it as Ally Bank BIC (Bank Identifier Code). They are the same thing and are both used for transferring money between banks. Some banks might use BIC code, some SWIFT number, and some both – BIC/SWIFT.

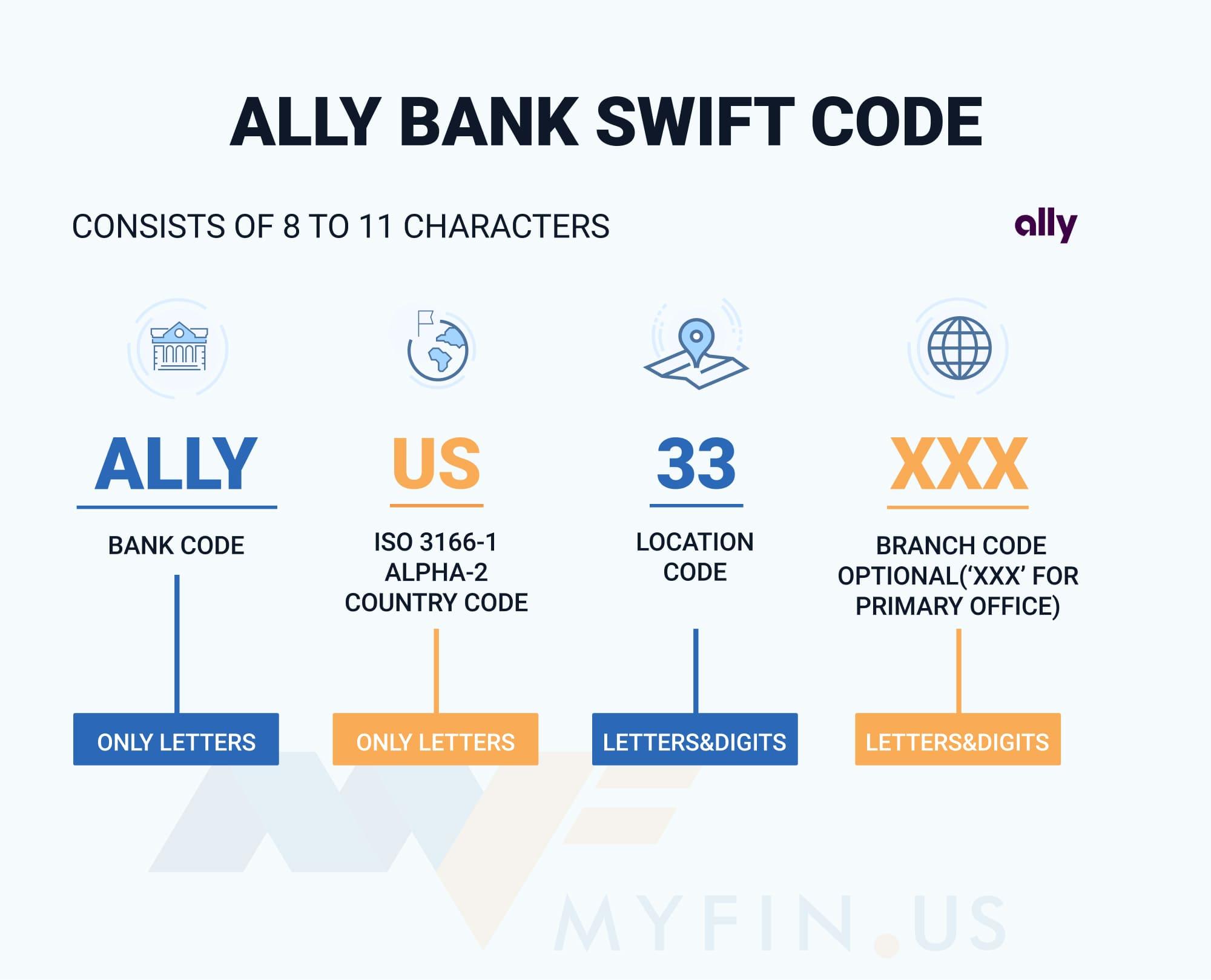

What does SWIFT code consist of?

A SWIFT code is usually an 8- or 11-digit number with the following format AAAABBCCDDD. These stand for:

- AAAA – four-character bank code (letters)

- BB – two-character country code (letters)

- CC – two-character location (institution's headquarters) code (numbers or letters)

- DDD – (optional) three-character branch code

How to use the right Ally Bank SWIFT/BIC code?

The SWIFT code is unique for each Ally Bank branch. In order not to make a mistake with SWIFT codes when making international wire transfers you may simply use the 8 digit head office SWIFT code – ALLYUS33. This way the payment will still achieve your account and you will not have to spend time finding the SWIFT code of your branch.

FAQ

Does Ally Bank SWIFT code change from branch to branch?

How to find Ally Bank SWIFT code?

How to do an international money transfer using SWIFT code?

- An international transfer is done similarly to a domestic wire transfer, with a few differences. In addition to the recipient's name and bank account number, you will need to enter the SWIFT code (or BIC) of the recipient's bank.

- When entering the amount you wish to transfer, pay attention to the transfer's currency. Once you enter the recipient's details, the amount might be automatically converted to the account's currency. However, this is not always the case, and you must double-check whether it's the preferred currency. If not, select the appropriate currency and then enter the amount. Otherwise, attempting to send money in a currency that your account does not support may result in the entire transaction being denied.

- On top of Ally Bank’s initial processing fee, you can expect to pay additional hidden fees imposed by any intermediary banks (or any other banking institution) and/or the recipient’s bank.

- Please note that international wire transfers may also require additional information from customers and take a few days to process.